State Insurance Commissioners Urged to Ensure 30% Paybacks; Some Insurers Lead the way

In a study issued last month, CFA and the Center for Economic Justice (CEJ) documented that the typical COVID-19 auto insurance premium relief provided by insurers to date was half what it should be based on a new analysis of driving and car crashes during the pandemic. According to the data, mileage and accidents fell by well over 50% during the pandemic, so the 15% refunds most auto insurance companies have promised is simply not enough relief. The groups’ report also showed that ongoing premium relief will be needed for June and at least several months following to account for the continued reduction in vehicles on the road, miles driven, and auto insurance claims.

CFA Director of Insurance J. Robert Hunter and Insurance Expert Doug Heller played a key role in prompting insurers to provide COVID-related relief to auto insurance policyholders announced in April. Despite that progress, Hunter said, “the data show most insurers should be doubling the relief they have promised consumers.”

The CFA-CEJ report provides a framework to help regulators navigate this unprecedented period, including the following recommendations:

- Traditional ratemaking – the actuarial exercise of projecting future claims and the premiums needed to cover those future claims – isn’t possible in the current uncertain environment and isn’t a solution to the current problem. A temporary program of monthly premium relief based largely on changes in the number of new claims filed from pre-COVID time frames is needed.

- Insurance regulators should provide guidance and assistance to insurers regarding the amount, methods and timing of relief payments and credits, including the collection and publication of data on new claims filings to support regulatory efforts, prevent unfair discrimination, assist insurers, provide public transparency, and transition to the new “normal” – whatever that turns out to be.

- Regulators should recognize and be prepared to account for the fact that not all states and sub-state locations will experience the same reduction in miles driven, vehicles on the road, and number and type of vehicle accidents.

- Regulators should also impose a moratorium on insurance credit scoring or, at a minimum, prohibit rate increases due to credit declines in the wake of the pandemic. Although the legitimacy of insurers’ use of consumer credit information to price insurance has always been controversial, it is clear that in the current environment any alleged relationship between credit history and expected claims has been ruptured and insurance credit scoring has become unfairly discriminatory.

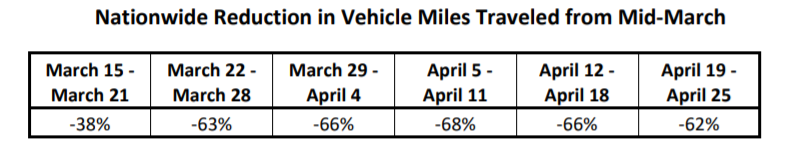

“With shelter-in-place restrictions and business closings, most people stopped driving or reduced their driving dramatically. With fewer cars on the road, there were dramatically fewer accidents. Fewer motor vehicle accidents should mean fewer auto insurance claims,” the report states. This is backed up by a deep-dive into Streetlight vehicle-miles-traveled (VMT) data. By the second week of April, VMT had reduced by 68% compared to the January 2020 baseline (see figure below for VMT data).

After the report came out, State Farm announced it would be providing an average 11% rate cut to their customers throughout the country. While State Farm’s announcement was welcomed, it also prompted CFA’s Hunter to send a letter urging state insurance commissioners to do more to ensure that pandemic-related auto insurance relief is sufficient.

“Market forces alone cannot and will not protect consumers from excessive premiums and urgent regulatory action is needed to ensure fair treatment of consumers and insurer compliance with statutory rate standards,” Hunter wrote.

After the letter was circulated to state insurance commissioners, Allstate and USAA both extended their monthly relief policies, tracking with the proposals set out by Hunter and Heller in their earlier mid-March letter.

“Allstate and USAA continue to provide premium relief to current customers in a timely fashion in amounts we hope reflect their actual reduction in claims,” said Hunter. “These insurers are providing relief to policyholders when they need it, and we applaud their industry leadership,” he added.

In contrast to the Allstate and USAA relief for June, other insurers are promising future rate cuts without addressing near term overcharges faced by existing customers. State Farm’s 11% reduction will not take effect until August or September and then only when customers renew their policy. American Family has promised a 10% rate reduction starting with July renewals. GEICO continues to withhold all relief from its customers until they renew their policy with the company.

While the actions of these three companies needs improvement, all other insurers, roughly 200 of them, have not acted at all to provide relief past May 31, 2020. In other words, they are charging auto insurance premiums that assume driving is completely normal, even though driving was still down 30% last week.

“In every state but New Hampshire, we are still required to buy auto insurance, even if we are hardly driving because of job losses, furloughs, school closures, or working from home. Those state laws haven’t changed, but the world has in the wake of this pandemic. State insurance commissioners need to do more to ensure that we are not paying pre-pandemic auto insurance premiums in a post-pandemic world,” said CFA’s Doug Heller.

USDA Limits Oversight of Genetically Engineered Crops

Despite a unified position from environmental groups, consumer organizations, biotech crop developers, and the food industry opposing the change, the U.S. Department of Agriculture (USDA) issued revised regulations last month that pave the way for a majority of genetically engineered and gene edited plants to escape oversight by allowing crop developers to self-determine whether their products are regulated. The agency refused to require developers even to notify the agency of products they believe are exempt under the new regulations released last month.

Historically, USDA has regulated most genetically engineered plants by requiring notification and permits for field research as well as a USDA determination that those plants do not cause harm before they are commercially planted by farmers. The new Trump Administration policy is not based on a risk assessment with scientific data that found the exempt plants safe, but instead is the result of USDA’s narrow reading of its statutory authority and its wish to deregulate wherever possible, according to CFA Director of Food Policy Thomas Gremillion.

“Consumers have a right to know how gene editing is being used to produce the foods they buy in the market,” Gremillion said, adding, “This rule will undermine public confidence in the food supply, and ultimately set back beneficial uses of this technology.”

20 Groups Allege TikTok Continues to Violate Children’s Privacy

The massively popular video sharing app, TikTok has come under fire for allegedly collecting personal information on children under age 13 without their parents’ consent and engaging in other violations of the Children’s Privacy Protection Act (COPPA). “This flagrant violation makes you wonder if anyone at the FTC is actually monitoring compliance with the settlements that the agency makes in privacy cases,” said Susan Grant, CFA Director of Consumer Protection and Privacy. “It’s another reason why we need a dedicated data protection agency in the U.S.”

This new allegation by CFA and 19 other consumer and privacy groups comes after TikTok entered into a settlement last year with the FTC that required the company to pay more than $5 million and change its practices to comply with the law. Under this settlement, TikTok (at the time, Music.ly) agreed to either destroy all personal information in its control at the time of the entry of the consent decree, or alternatively, to destroy all personal information collected from users under 13 years of age.

The groups allege that this not only did not happen, but that TikTok has many regular users who are under the age of 13, many of whom still have videos of themselves that were uploaded as far back as 2016, years prior to the consent decree. According to the groups, TikTok has not received parental consent for these accounts and still fails to make reasonable efforts to ensure that a parent of a child receives direct notice of its practices regarding the collection, use, or disclosure of personal information, something required by the terms of the consent decree.

TikTok has attempted to set up “younger users accounts” for children under 13 in the United States. However, the groups do not believe this option satisfies the COPPA rule. In fact, these “younger users accounts” actually incentivize children to lie about their age since these accounts are limited by not allowing users to share videos with others. TikTok continues to further violate COPPA by failing to post a prominent and clearly labeled link to an online privacy notice of its information practices with regard to children on the homepage of the TikTok app, the groups allege.

“TikTok continues to compromise the privacy of the children still present on its platform, and its behaviors continue to contravene the very goals of COPPA,” the groups wrote. “Children using TikTok accounts are denied COPPA’s protections, and their parents are denied any opportunity to protect the privacy of their children, or even the opportunity to have a say in such protection. Denying parents knowledge and the ability to intervene in this data collection goes against the very purpose of COPPA,” the groups wrote.

Groups Urge DOE to Review Standards and Set Deadlines for Overdue Energy Conservation Rules

CFA and other consumer and environmental groups provided two sets of comments to the Department of Energy (DOE) last month urging the agency to implement a regulatory schedule that achieves compliance with all overdue and pending statutory deadlines for rulemakings; to drop discretionary rulemakings that run contrary to the statutory purpose of energy conservation and that would be illegal if finalized; and to complete overdue actions to update standards and test procedures.

In the first set of comments, the groups focused on the growing backlog at the DOE and urged the agency to set a schedule to deal with it. They stressed how DOE needs to drop discretionary rulemakings in order to free up time to work on its overdue statutory obligations and to work on discretionary rulemakings that would save energy. The groups pointed out the implications for consumers, “Missed deadlines mean that some of these potential savings [from efficiency standards] are now irrevocably lost. As compliance dates for future standards are pushed further and further into the future, millions of needlessly wasteful products are sold and installed, locking in higher energy use, utility bills and polluting emissions for the lifetimes of those products.” DOE was urged to develop and implement a regulatory schedule that achieves compliance with all overdue and pending statutory deadlines.

The second letter focused on the legal obligations the DOE has placed on it by Congress. The groups stated that, “The Department has fallen far behind the schedule established in the Energy Policy and Conservation Act (“EPCA”) for the completion of proposed and final rules to update test procedures and energy conservation standards for covered products and equipment… Because EPCA explicitly reflects Congress’s intent to have energy conservation standards and test procedures reviewed and updated according to the schedule prescribed in the Act, DOE cannot lawfully extend the statutory deadlines to perform those actions.” They urged DOE to update the standards and test procedures required by Congress.

“It is so blatantly irresponsible that this DOE is ignoring its legal obligation on over two dozen energy efficiency standards and test procedures covering a wide variety of products, including home appliances, such as room air conditioners, clothes washers, and refrigerators. By not taking up its mantle, DOE is unnecessarily robbing consumers of savings on their energy bills as well as harming our economy and the environment. I hope that our comments will be carefully considered and that ultimately, we will see DOE take action to meet its legal responsibilities,” said Mel Hall-Crawford, CFA Director of Energy Programs.

New Website Provides Critical Information on COVID-19 Mortgage and Rent Relief

A new website, hosted by the Consumer Financial Protection Bureau (CFPB) and co-sponsored by HUD-FHA and the Federal Housing Finance Agency (FHFA), has been established to provide quick links to specific topics of interest to consumers faced with challenges paying their mortgages or their rent during the COVID-19 pandemic. CFA Senior Fellow Barry Zigas applauded the action, stating, “This consolidated site will make it much easier for consumers to get current information about their options as Congress and the Administration consider additional measures during the National Emergency.”

CFA and 32 other national and state consumer and civil rights organizations had voiced support earlier for the creation of such a website and were pleased to see it come to fruition.

“Getting the right information to consumers with a website that links to all of the federal government’s relief efforts is a good step forward. It should help reduce confusion among consumers and make it easier for them to get reliable information about their options… We are very pleased that the Administration has acted,” concluded Zigas.

The website is available in the link above or here at this link.